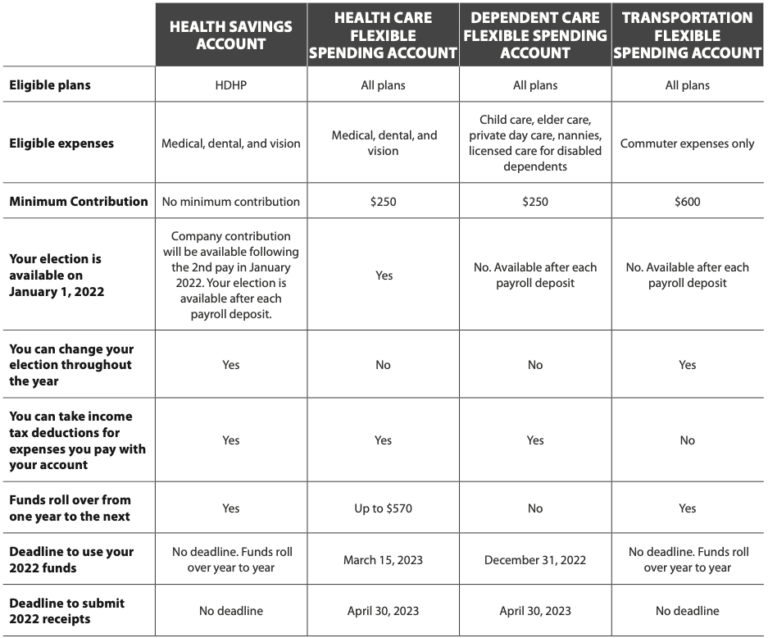

For dependent care expenses, it can provide more tax advantage than the federal income tax credit. Your employees pay these expenses to ensure during working hours, their children get the attention and care they need. Some employees who have children under the age of 13, pay dependent care expenses. *Qualified Life event that allows medical plan change are, but not limited to marriage, birth or adoption, divorce, death or change in residence. The election must be done within 31 days from the date of the qualifying event or the participant will be required to wait until their company's annual open enrollment period. Funds are available for those claims after the account is set up. Funds are available for those claims incurred after the account is set up.Ĭurrent HCFSA participants who encounter a qualified life event* may enroll in an FSA if not already enrolled or increase their election. You may contact your HR/Benefits department to see your company's policy of eligibility. New hires that are eligible to enroll in an FSA must do so within 31 days from when they become eligible with their employer. You may contact your HR/Benefits department to see when your company holds their annual open enrollment. Insurance premiums are NOT reimbursable through the HCFSA.Ĭurrent HCFSA participants MUST re-enroll in the plan each year in order to continue participation. It will be a permanent tax savings, which helps your health care dollars, go further. You never have to pay taxes on the money you receive from your HCFSA account for qualified expenses. This account can benefit almost all eligible employees, their spouses, children and dependents. This means it is an amount deducted from your gross pay before federal income, Social Security, and Medicare taxes are calculated. When you join, you choose to contribute a set amount to your HCFSA through payroll deduction on a pre-tax basis. The Health Care Flexible Spending Account (HCFSA) is an IRS- approved, tax-exempt account that saves you valuable tax dollars on eligible medical, dental, vision, prescription and prescribed over-the-counter expenses. If your provider does not accept Visa, you may pay your provider directly, then submit a receipt and wait for a reimbursement check or have the money deposited directly into your bank account. You won't have to reach into your pocket to pay for qualified expenses, file a claim and then wait to get reimbursed. Then when you're ready to use the money in your flex account, simply swipe your take care Visa flex benefits card for qualified expenses, money is instantly deducted from your flex benefit account. She pays her insurance premiums and health and day care expenses through the plan with tax-free dollars - and she saves $100 each month! Her paycheck without the planĪfter you've decided how much money you want to set aside on each paycheck and how you want to spend it, enroll in the plan. An employee makes $2,000 each month and decides to participate in her employer's plan. Here's an example of how a typical employee's take-home pay will increase as a result of participating in the take care® plan.

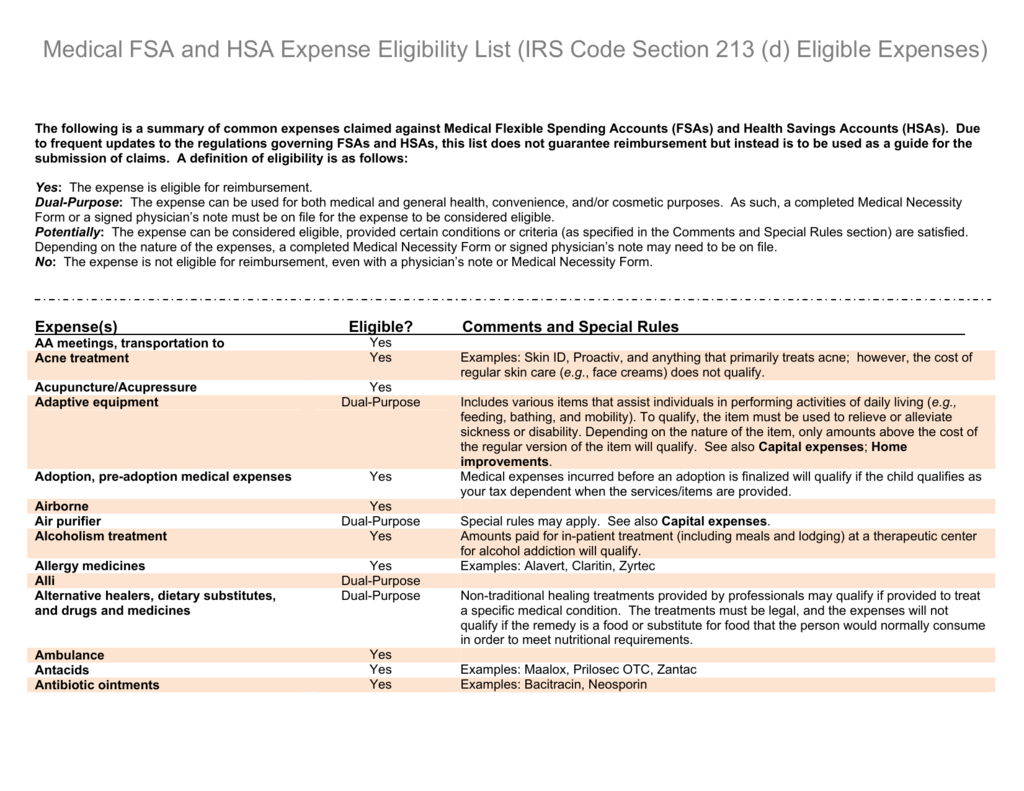

Insurance premiums are NOT reimbursable through the HCFSA.Ĭlick here for a list of FSA Eligible Expenses Section 125 Limited Benefits Enrollment Formĭon't forget - You can submit your debit card substantiation and/or request reimbursement for out-of-pocket expenses, using your Mobile device. Section 125 Benefits Enrollment Form – Spanish Version Health/Limited FSA Reimbursement Claim Formĭependent Care Spending Account Reimbursement Claim Form Canceled checks, credit card slips, or statements of balance due are NOT ACCEPTABLE. The document must include the service provider's name, the service rendered date and type of service(s) for each expense. When filing your claim, you must attach copies of the itemized statements/EOB (Explanation of Benefits).

0 kommentar(er)

0 kommentar(er)